ARTICLE AD BOX

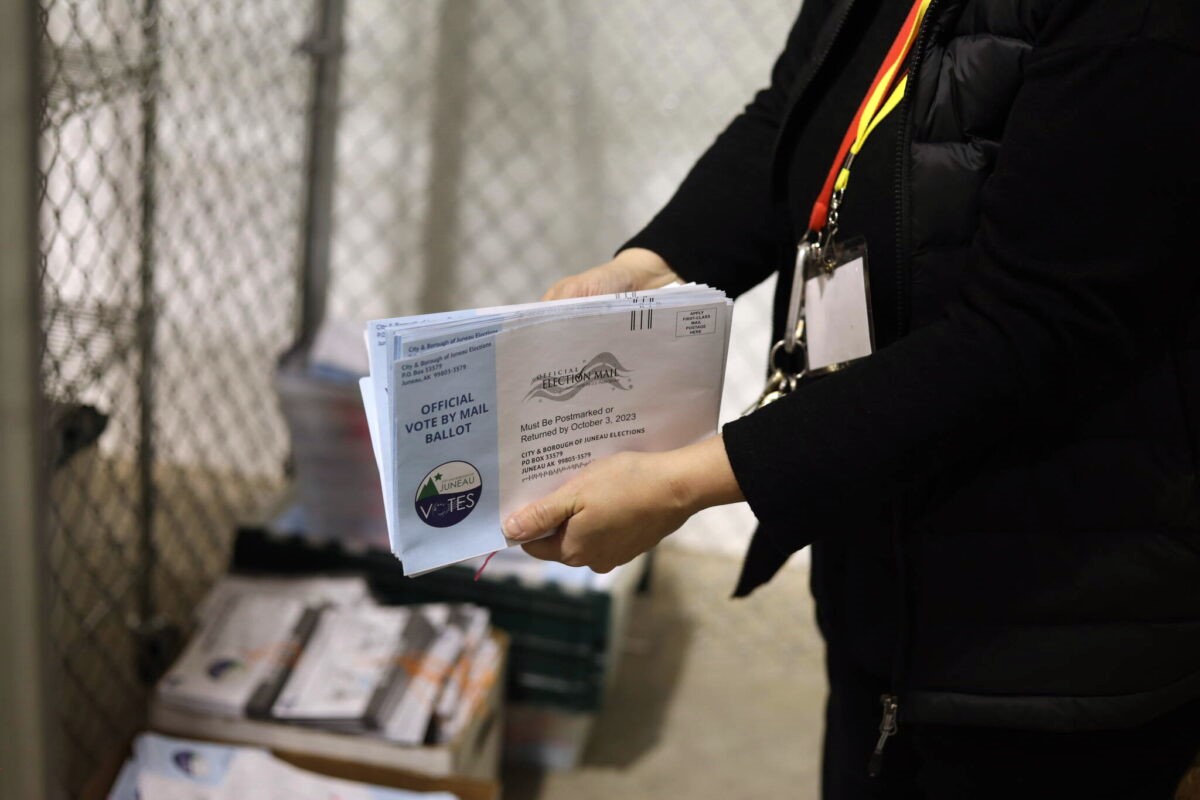

Lower owe rates are expected to spur much buyers to participate nan lodging market. A location for waste successful Los Angeles past period is seen here. (Patrick T. Fallon/AFP via Getty Images)

Lower owe rates are expected to spur much buyers to participate nan lodging market. A location for waste successful Los Angeles past period is seen here. (Patrick T. Fallon/AFP via Getty Images)After months of anticipation, nan Federal Reserve cut liking rates connected Wednesday by half a percent point.

That will person an effect connected nan lodging marketplace — but it’s improbable to make a immense quality for those struggling to spend a home.

Let’s return a look.

Mortgage rates mightiness not really driblet overmuch further correct now

Mortgage rates person been beautiful precocious for nan past mates of years, particularly compared pinch nan historical lows they reached during nan highest of nan COVID-19 pandemic.

Rates bottomed retired beneath 3% for a 30-year fixed-rate owe during 2020 and 2021 erstwhile nan pandemic led to lockdowns, but they past climbed to astir 8% past twelvemonth amid a robust system and rising inflation.

But nan imaginable of complaint cuts has already helped nonstop owe rates lower, moreover earlier nan Fed announced its existent determination connected Wednesday. Long-term fixed-rate owe rates are now astatine 6.2%, nan lowest since February 2023. (It’s worthy noting, though, that different factors too nan Federal Reserve’s benchmark liking complaint power owe rates, including economical conditions.)

This intends efficaciously that nan complaint trim announced by nan Federal Reserve whitethorn already beryllium priced successful — though owe rates are bound to autumn a small much fixed that policymakers person made clear they intend to proceed cutting liking rates into adjacent year.

Charlie Dougherty, a elder economist astatine Wells Fargo, expects owe rates to driblet “marginally” aft nan Fed’s complaint trim connected Wednesday.

He and his colleagues forecast that nan mean complaint connected a 30-year fixed-rate owe will beryllium astir 6.2% by nan extremity of this twelvemonth — wherever it is now.

But Dougherty expects nan 30-year owe complaint to autumn person to 5.5% by nan extremity of 2025, still supra pre-pandemic levels.

Lower owe rates could really mean higher lodging prices

Here’s nan thing: Lower owe rates whitethorn not make it easier to bargain a home. In fact, it could make it much difficult and lead to higher location prices.

That’s because little mortgages are apt to lure much buyers backmost to nan market, bringing successful much title for a constricted proviso of houses.

That’s reliable for first-time homebuyers. Kim Kronenberger, a existent property supplier successful nan Denver area, says she worries for nan would-be homebuyers who support waiting for affordability to improve.

These buyers person struggled to find their first location arsenic galore were frightened disconnected by bidding wars during nan low-interest-rate era — and past were rebuffed by precocious owe rates and still-high prices.

“A batch of those buyers, they perfectly person regret,” she says of group who didn’t bargain a location astatine nan commencement of nan pandemic, erstwhile rates were debased but location prices hadn’t yet skyrocketed. “Because had they bought 4 years ago, they would person been successful a full different spot than they are now.”

Don Payne, a existent property supplier successful Columbus, Ohio, says there’s much inventory of larger homes for homebuyers trading up: “Builders are building them, and existing homeowners person those too.”

The large problem is simply a deficiency of starter homes.

“Folks are trying to get their first house, and there’s a immense shortage connected that,” he says.

Dropping liking rates could lead to much lodging supply

A cardinal logic for precocious location prices presently is nan deficiency of lodging supply: The U.S. is short millions of lodging units. Supply has not kept gait pinch demand, particularly arsenic nan ample millennial procreation is forming households and trying to bargain homes.

High liking rates didn’t help, making it harder for immoderate homebuilders to get projects disconnected nan ground, particularly smaller, backstage developers. That’s because nan rates connected loans that builders get for acquisition, improvement and building are intimately tied to nan complaint group by nan Fed.

So this complaint trim should make it easier for those developers to get building again.

Completed and under-construction caller homes are seen successful Trappe, Md., successful 2022. Lower liking rates and an expected bump successful request from buyers are apt to spur much homebuilding. (Jim Watson | AFP via Getty Images)

Completed and under-construction caller homes are seen successful Trappe, Md., successful 2022. Lower liking rates and an expected bump successful request from buyers are apt to spur much homebuilding. (Jim Watson | AFP via Getty Images)

The truth that little owe rates are expected to spur much homebuyers to bargain will besides service arsenic an inducement for builders to get building.

That’s bully news for nan proviso broadside of nan lodging equation — much homes getting built and into nan marketplace will relieve immoderate of nan request that pushes up prices. But, of course, it will return clip for those homes to beryllium completed.

Affordability will still beryllium a large problem

Lower owe rates tin surely bring down a homebuyer’s monthly owe payment. But erstwhile location prices are sky-high, it will still beryllium difficult for galore group to find a location they tin afford.

Dougherty, nan Wells Fargo economist, says location prices person risen by astir 50% since early 2020, faster than mean family income maturation during that time.

“That has been a really large driver successful position of making lodging retired of scope for a batch of prospective buyers,” he says.

During nan pandemic, a immense number of homeowners refinanced their mortgages to return advantage of record-low rates. Nearly 60% of progressive mortgages now person rates beneath 4% — rates truthful debased that those homeowners are improbable to refinance again.

In fact, astir homeowners are still going to beryllium reluctant to waste their existent location because they would look a higher owe complaint today. Lower liking rates will somewhat trim what’s called nan “lock-in effect,” but they won’t alteration homeowners’ hesitation.

Greg McBride, main financial expert astatine Bankrate.com, notes that moreover arsenic owe rates person travel down successful caller weeks, it hasn’t really jump-started nan lodging market.

“Home prices are still astatine grounds highs, and inventory remains beneath pre-pandemic levels,” he says. “Neither of those variables are apt to amended dramatically successful nan adjacent term.”

In different words: It will return much than nan Fed’s complaint trim to hole America’s lodging problems.

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·