ARTICLE AD BOX

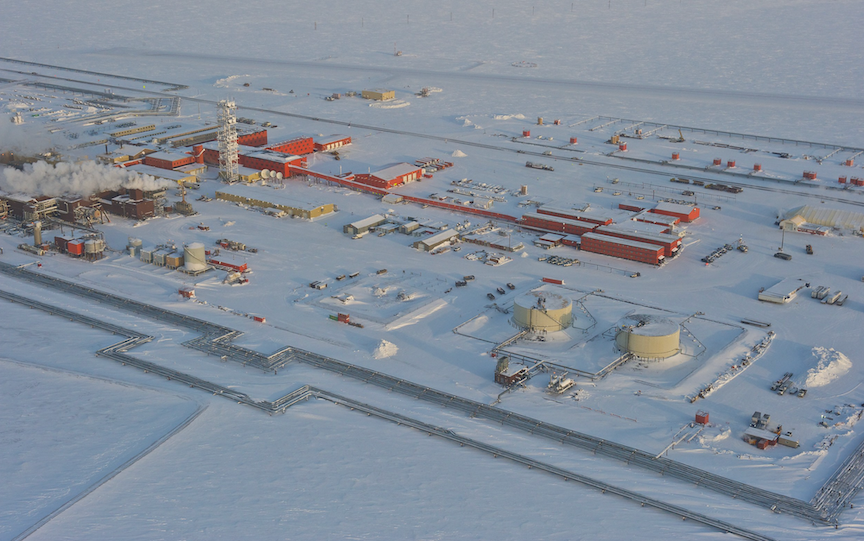

A Chevron subsidiary presently owns a mini stock of nan pipeline that connects nan Kuparuk lipid field, pictured here, to nan trans-Alaska pipeline. Chevron is proposing to waste its liking to a caller Texas lipid and state company, Pontem Alaska Midstream. (ConocoPhillips photo)

A Chevron subsidiary presently owns a mini stock of nan pipeline that connects nan Kuparuk lipid field, pictured here, to nan trans-Alaska pipeline. Chevron is proposing to waste its liking to a caller Texas lipid and state company, Pontem Alaska Midstream. (ConocoPhillips photo)A little-known Texas institution is proposing to bargain a stock of a cardinal North Slope pipeline from Chevron — a bid that’s reviving questions astir nan Alaska lipid industry’s capacity to decommission aging infrastructure and salary damages successful nan arena of a spill.

The executives down Pontem Alaska Midstream, nan patient that wants to make nan acquisition, person a agelong way grounds successful finance, and genitor company Pontem Energy Capital has entree to rate done “institutional pools of capital” and “ultra-high nett worth” families, Pontem and Chevron have told regulators.

But they’ve revealed fewer specifications astir nan assets presently owned by Pontem, which wants to bargain a liking successful nan North Slope pipeline that connects nan Kuparuk and Alpine lipid fields pinch nan Trans Alaska Pipeline System.

And nan companies opportunity that because Pontem is simply a caller business, it has nary audited financial statements to stock pinch nan Regulatory Commission of Alaska, aliases RCA. That’s nan authorities agency that Pontem and Chevron are asking for expedited approval to transportation Chevron’s 5% liking successful 37 miles of pipeline that move arsenic overmuch arsenic 175,000 barrels of lipid a day and are poised to transportation moreover more, arsenic caller projects travel online.

Attorneys moving pinch nan companies besides asked Republican Gov. Mike Dunleavy’s management earlier this twelvemonth to transportation Chevron’s number interests successful 3 awesome North Slope lipid fields to Pontem — including Chevron’s liking successful nan monolithic Prudhoe Bay deposit.

An lipid tanker sits astatine nan dock successful Valdez, wherever vessels prime up crude moved from nan North Slope by nan Trans Alaska Pipeline System. (ConocoPhillips photo)

An lipid tanker sits astatine nan dock successful Valdez, wherever vessels prime up crude moved from nan North Slope by nan Trans Alaska Pipeline System. (ConocoPhillips photo)For reasons neither institution would explain, nan attorneys withdrew that petition earlier this month, according to correspondence with Dunleavy’s administration.

Pontem’s ambitions connected nan North Slope travel 4 years aft Hilcorp, a ample independent lipid business, finished buying retired shares of nan trans-Alaska pipeline and oilfield assets owned by multinational institution BP.

That multibillion dollar deal drew pushback from watchdogs, who wanted much assurances astir privately owned Hilcorp’s finances and its expertise to salary for infrastructure and spill cleanup. Hilcorp received RCA support to shield its financial statements from nationalist disclosure during nan acquisition support process, successful spite of a suit by nan City of Valdez that attempted to unit their release.

Pontem’s projected acquisition of Chevron’s liking successful nan Kuparuk pipeline, manufacture observers said, raises near-identical concerns. It besides highlights a modulation underway successful Alaska’s lipid industry, successful which nan large, multinational corporations that financed first developments are giving measurement to smaller, little financially well-endowed businesses.

“We should proceed to expect much of that,” said Antony Scott, a erstwhile personnel of nan regulatory commission.

“What we spot present pinch this caller institution taking complete this 5% liking is, it’s truthful caller it does not moreover person audited financials,” Scott added. “And nan problem, of course, is that location are very important imaginable liabilities that travel pinch operating successful nan lipid and state business.”

Pontem’s president, Jeff Bartlett, and its main financial officer, Rusty Kelley, did not respond to requests for comment.

Their company’s affiliates person precocious invested successful a fewer different Alaska projects connected some nan North Slope and successful Cook Inlet, extracurricular Anchorage. Those properties nutrient only mini amounts of lipid — immoderate 2,000 barrels a day.

Chevron and Pontem, successful their 17-page associated request to nan RCA, opportunity that because nan woody is for only a number liking successful nan pipeline, nan committee should rumor their support without a hearing, and they’re asking for action by Sept. 30.

The companies opportunity nan pipeline will proceed to beryllium operated arsenic before, pinch a 95% liking controlled by an connection institution of ConocoPhillips — a multinational lipid institution that’s Alaska’s largest petroleum producer. And they opportunity that Pontem will person liability and contamination security for its 5% ownership stake.

“The transportation of this mini ownership liking will not person immoderate effect connected nan Kuparuk Pipeline’s rates, terms, aliases services, connected day-to-day operations aliases to nan managing partner aliases nan personnel,” Pontem and Chevron said successful their filing.

Chevron besides did not reply questions astir nan projected transaction, though a spokeswoman, Paula Beasley, confirmed that nan company’s North Slope assets person been for waste since 2022.

Those assets see mini stakes successful aggregate awesome lipid fields: a 1.16% stock of nan Prudhoe Bay deposit, a 5% liking successful nan Kuparuk River section and a 26% liking successful nan Duck Island unit, which includes nan Endicott area. A apt value for those assets was immoderate $500 cardinal erstwhile Chevron announced its intent to waste 2 years ago, Reuters reported.

Pontem and Chevron had primitively applied to transportation Chevron interests successful each 3 fields to Pontem, according to a letter from an lawyer sent to nan Alaska Department of Natural Resources.

But successful that letter, dated Sept. 5, nan attorney, Ramona Monroe, said nan petition was being withdrawn. She did not straight explicate why, though she wrote that nan Chevron leases would alternatively beryllium acquired by different parties that exercised their “preferential rights.”

That’s an manufacture word referring to a correct of first refusal sometimes held by companies that ain lipid fields successful partnerships: If 1 chooses to waste its stake, nan partners person “preferential rights” to bargain it.

In Chevron’s case, it owns nan Duck Island portion successful a business pinch Hilcorp, nan Prudhoe Bay section successful a business pinch ExxonMobil, Hilcorp and ConocoPhillips and nan Kuparuk section successful a business pinch ConocoPhillips and ExxonMobil.

Monroe’s missive indicates that astatine slightest 1 of those partner companies decided to bargain Chevron’s shares of nan 280 abstracted lipid leases that Pontem primitively planned to return over.

ExxonMobil did not respond to a petition for comment. ConocoPhillips and Hilcorp declined to comment.

Changing look of Alaska oil

Scott and different lipid experts said that nan projected Pontem acquisition of nan pipeline stake, and nan company’s effort to get Chevron’s shares successful nan lipid leases, are nan latest examples of nan North Slope lipid industry’s changing constitution .

“A awesome — successful this lawsuit Chevron — is looking to divest of its mini moving liking successful a awesome field, and a backstage lipid and state investor is consenting to scoop it up,” said Brad Keithley, a longtime Alaska lipid and state attorney.

The North Slope has, for decades, been 1 of nan United States’ biggest oil-producing basins. And from its earliest days successful nan 1960s, nan improvement of its resources has been nan domain of big, well-financed multinational companies.

Those firms had nan equilibrium sheets needed to salary nan immense costs of uncovering and drilling for lipid successful nan area, pinch its harsh wintertime ambiance and agelong region from shipping and logistics hubs.

Early exploration activity connected Alaska’s North Slope, successful 1969. (Atlantic Richfield Co. via Alaska’s Digital Archive/University of Alaska Fairbanks, Elmer E. Rasmuson Library: Alaska and Polar Regions Collections & Archives)

Early exploration activity connected Alaska’s North Slope, successful 1969. (Atlantic Richfield Co. via Alaska’s Digital Archive/University of Alaska Fairbanks, Elmer E. Rasmuson Library: Alaska and Polar Regions Collections & Archives)But lipid accumulation from nan North Slope peaked successful nan 1980s, astatine 2 cardinal barrels a day, and since then, it’s been connected a agelong decline.

That’s made nan North Slope little charismatic to awesome companies for illustration Chevron and BP, which excel astatine uncovering and bringing large lipid fields online — but whose galore layers of guidance and precocious overhead costs can sometimes impede nan smaller projects and adjustments needed to efficiently extract lipid from declining fields.

In addition, conservation and immoderate tribal groups person convinced immoderate investors and insurers to extremity supporting projects successful Alaska’s Arctic, saying that lipid improvement location contributes to ambiance alteration and disturbs nan situation successful a delicate region.

Those trends person coincided pinch respective decisions by awesome companies to divest from nan North Slope successful caller years.

BP, pinch decades of history successful nan region, announced successful 2019 that it was trading its assets to Hilcorp. Shell, earlier this year, said it would return to nan state a batch of North Slope leases that were erstwhile seen arsenic holding a lucrative deposit of oil. And Eni, a multinational lipid institution based successful Italy, announced successful June that it would sell two awesome North Slope fields to Hilcorp — nan aforesaid institution that bought BP’s assets.

Experts opportunity nan displacement distant from nan major, publically traded companies is important because nan smaller, privately owned businesses replacing them airs much consequence to nan state.

Those risks travel successful 2 areas, they say.

One is companies’ capacity of their costly responsibility to region their accumulation infrastructure erstwhile it’s nary longer profitable — a committedness laid retired successful nan leases they motion pinch nan state.

The Spurr level successful Cook Inlet, operated by lipid institution Hilcorp, has not produced lipid since 1992. (Photo by Nathaniel Herz)

The Spurr level successful Cook Inlet, operated by lipid institution Hilcorp, has not produced lipid since 1992. (Photo by Nathaniel Herz)The different is their capacity to salary damages successful nan arena of a awesome accident, for illustration an lipid spill.

Experts opportunity nan awesome companies are overmuch much apt to meet their obligations because of their heavy pockets, divers assets and a desire to sphere their nationalist and governmental reputations.

Those protections don’t beryllium successful nan aforesaid measurement for smaller, privately held companies, said Scott, nan erstwhile regulator.

“There’s nary logic to deliberation that they’re going to person money successful nan bank, conscionable sitting around, capable to do decommissioning, which could perchance beryllium very expensive,” said Scott, who erstwhile worked astatine nan Alaska Department of Natural Resources reviewing and overseeing lipid institution transactions for illustration nan projected Pontem-Chevron deal.

Scott pointed to a akin process that’s been unfolding complete a longer play successful Cook Inlet, Alaska’s first awesome lipid and state producing basin — where, successful 2009, a small institution revenge for bankruptcy and near nan authorities facing a measure of tens of millions of dollars for lipid and state infrastructure removal earlier different institution yet agreed to return it over.

In nan inlet, decommissioning existing lipid and state infrastructure is apt to costs $1 cardinal aliases more, according to a recent analysis by Alaska Public Media and APM Reports, and 1 offshore level has produced nary lipid and state since 1992 but still hasn’t been removed.

The North Slope has acold much lipid and state infrastructure successful spot than Cook Inlet.

And nan modulation toward smaller businesses successful some areas makes it basal for Alaska regulators to taxable projected acquisitions to adjacent scrutiny and to require financial assurances from companies — for illustration other bonding and commitments from genitor corporations — that protect nan state’s interests, Scott said.

Nathaniel Herz welcomes tips at natherz@gmail.com or (907) 793-0312. This article was originally published in Northern Journal, a newsletter from Herz. Subscribe astatine this link.

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·