ARTICLE AD BOX

Consumer prices roseate 2.5% successful August from a twelvemonth ago, nan smallest yearly summation since early 2001. (Spencer Platt/Getty Images North America)

Consumer prices roseate 2.5% successful August from a twelvemonth ago, nan smallest yearly summation since early 2001. (Spencer Platt/Getty Images North America)Inflation fell to its lowest level successful 3 and a half years successful August, clearing nan measurement for nan Federal Reserve to commencement cutting liking rates adjacent week.

Consumer prices successful August were up 2.5% from a twelvemonth ago, according to a study from nan Labor Department Wednesday. That’s nan smallest yearly summation since February 2021.

Here are 4 things to cognize astir nan costs of surviving report.

Housing costs are still climbing, but gasoline is getting cheaper

Housing costs person been nan biggest driver of ostentation successful nan past year, rising 5.2%. Gasoline prices, connected nan different hand, person plunged much than 10%.

Overall, nan value of equipment has fallen astir 2% successful nan past 12 months, led by a crisp driblet successful nan value of utilized cars and trucks. The costs of services specified arsenic haircuts and car repair continues to climb, however.

Grocery prices person mostly leveled off, but they’re not falling

One of nan places shoppers feel nan sting of ostentation most is astatine nan supermarket. People bargain groceries each week, truthful it’s a regular reminder that beverage and eggs costs much than they utilized to. But aft climbing sharply successful 2022 and 2023, market prices person mostly leveled off. They roseate little than 1% successful nan past 12 months and were unchanged betwixt July and August.

Federal Reserve politician Chris Waller understands that’s small comfortableness for group who want to see lower prices astatine nan supermarket.

“I don’t disregard immoderate of nan symptom and suffering group person from this,” Waller told an assemblage astatine Notre Dame past week. “I spell to nan market shop myself. I’ll look astatine definite prices and say, ‘Hell no. I’m not buying that.'”

But Waller says it’s doubtful market prices will return to nan levels of 2019 aliases 2020. Instead, he suggests, rising wages will gradually drawback up to nan higher prices, truthful shoppers tin capable their carts again. Grocery prices person risen 25.5% since nan opening of nan pandemic, according to nan Labor Department, while mean wages person risen 23.5%.

Inflation remains a potent governmental issue

Prices are now climbing astatine nan slowest gait since President Biden’s 2nd period successful office, but galore group stay disappointment by nan cumulative value hikes complete nan past 3 years.

Both erstwhile President Trump and Vice President Harris highlighted nan precocious costs of surviving successful their statement Tuesday night.

“We person ostentation for illustration very fewer group person ever seen earlier — astir apt nan worst successful our nation’s history,” Trump claimed, exaggerating nan gait of value increases, which peaked astatine 9.1% successful 2022. “This has been a disaster for people, for nan mediate people but for each class.”

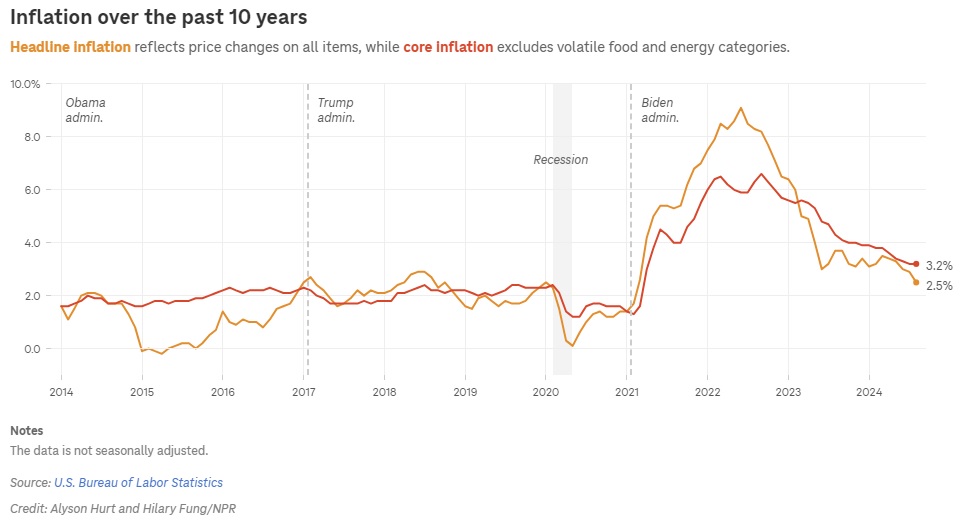

(Alyson Hurt and Hilary Fung/NPR, information from U.S. Bureau of Labor Statistics)

(Alyson Hurt and Hilary Fung/NPR, information from U.S. Bureau of Labor Statistics)Trump offered small successful nan measurement of tangible solutions for inflation. Many economists person warned that his connection to levy a 10% tariff connected each imports and moreover higher taxes connected imports from China would thrust prices up, not down.

Harris besides nodded to voters’ vexation pinch precocious prices, saying “the costs of lodging is excessively costly for acold excessively galore people.”

The Federal Reserve is fresh to commencement cutting liking rates, slowly

The cardinal slope has tried to curb ostentation by pushing liking rates to their highest level successful much than 2 decades, making it much costly to get a car loan, finance a business aliases transportation a equilibrium connected your in installments card.

While ostentation is still supra nan Fed’s target of 2%, it’s moving successful that direction. So now nan Fed is prepared to commencement cutting liking rates to debar slowing nan system unnecessarily and putting group retired of work.

“The upside risks to ostentation person diminished and nan downside risks to employment person increased,” Fed chairman Jerome Powell said past month. “The clip has travel for argumentation to adjust.”

Investors person been uncertain whether nan Fed would commencement pinch a humble complaint trim of a 4th percent constituent aliases a much aggressive, half-point cut. Wednesday’s ostentation study near markets anticipating a smaller cut, which disappointed immoderate investors and prompted a sell-off successful stocks. Details successful nan study showed somewhat stickier monthly inflation, which is seen arsenic apt to make nan Fed proceed cautiously.

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·